2026 City Budget Adopted

The City of Oshawa’s 2026 budget has been adopted following a thorough process that included community engagement, a meeting to hear public delegations and a Special Meeting of Council where members of Council had the opportunity to propose budget amendments.

The 2026 Operating Budget is $207.8 million, and the total gross cost of the 2026 Capital Budget is $44.5 million. The 2026 Operating and Capital Budget and the Nine-year Capital Forecast reflect the City’s commitment to affordability, exceptional service delivery, and long-term financial sustainability.

The City Budget also reflects the impact of downloading from other levels of government, rising costs, tariffs, and supply chain disruptions, while remaining sensitive to the affordability challenges faced by residents and local businesses as well as supporting our external agencies.

The 2026 Budget carefully considered many factors including a line-by-line review of expenditures; assessment of best practices; evaluation of operations and maintenance plans; and the identification of new revenue sources.

Budget Highlights

$44.5 million invested in major projects including:

- Stevenson Road North major reconstruction

- reconstruction of roads in the Sun Valley area

- reconstruction of Meadow Street from Avalon Street to Manor Drive

- reconstruction of Myers Street from Wolfe Street to Conant Street

- plus ongoing multi-year work on Conlin Road East and Thornton Road

- enhancements to improve safety, accessibility and recreation including the Lakeview Park enhancement project

These projects are in addition to the $50 million investment committed earlier this year by Council. The modernization will include a main entrance expansion, fan experience upgrades, interior renovations, increased seating and an updated concession area.

$16.8 million (includes $2.5 million of in-kind services) to support the following external agencies and organizations:

- Oshawa Senior Citizens Centres

- The Robert McLaughlin Gallery

- Parkwood National Historic Site

- Oshawa Tourism (through the Greater Oshawa Chamber of Commerce)

- Oshawa Historical Society

- Oshawa Public Libraries

Although Housing, Homelessness, Mental Health, Addiction and Social Services are the responsibilities of the Region of Durham as legislated by the Province, the City invests over $5 million annually to address health and safety concerns. Examples of these programs and measures include:

- a specialized Fire Response Unit that responds to 3,000 medical calls yearly

- increased Security and By-law costs

- increased costs to clean up garbage, human waste, used syringes and to remove graffiti in the downtown

- providing community improvement grants to help businesses make investments in crime prevention through environmental design and repairs to property

Let's talk about the City Budget

The City of Oshawa’s 2026 Budget has sparked discussion, reflecting how much our community cares about the city’s future.

Municipal budgeting is a complex and thorough process that involves many factors. We are committed to building an understanding of the municipal budget process and how your tax dollars are invested back into your community.

To take a closer look at Oshawa’s 2026 Budget and what it means for you, we invite you to learn more with our Budget Fact Sheet below.

Budget Levy vs Tax Rate

Did you know?

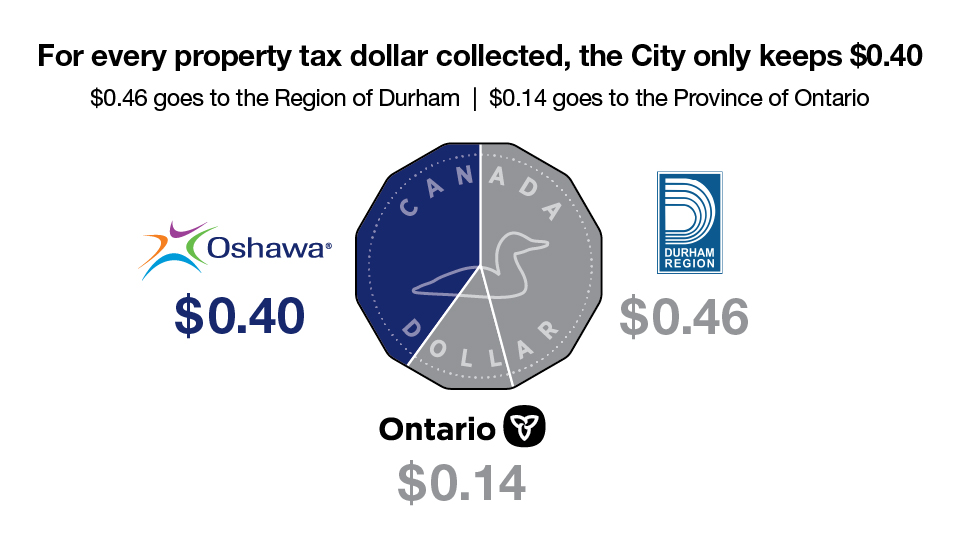

Your property tax bill is made up of three main components:

- Municipal Taxes

This tax rate covers the cost of supplying municipal services, which is driven by the City’s budget levy. - Regional Taxes

These taxes are based on the tax rate adopted by the Region of Durham for services including transit, housing, shelter, public health and emergency services. - Provincial Taxes

This portion is remitted to the Province of Ontario for education.

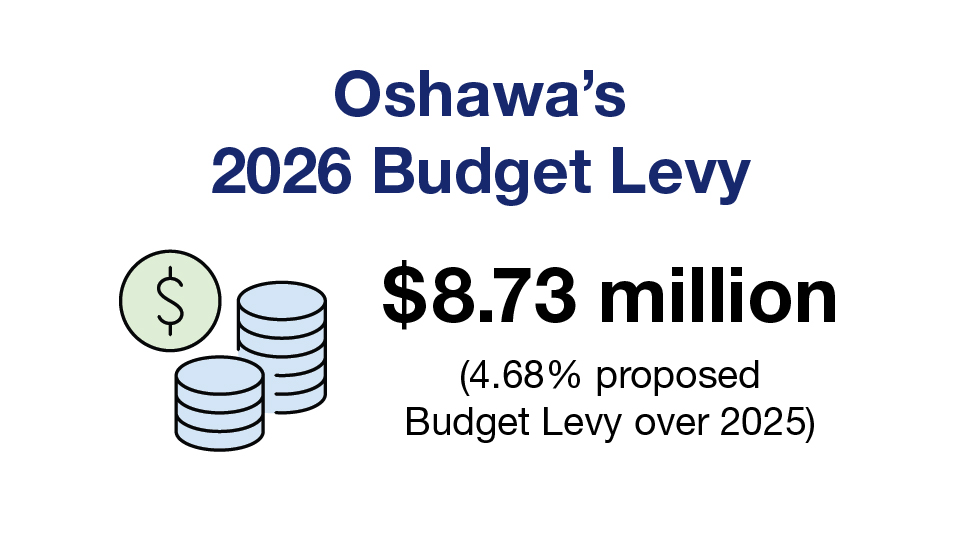

What's a Budget Levy?

The total dollar amount the City needs to raise to fund services, after accounting for other revenue sources.

The 2026 Budget Levy increase as presented is $8.73 million.

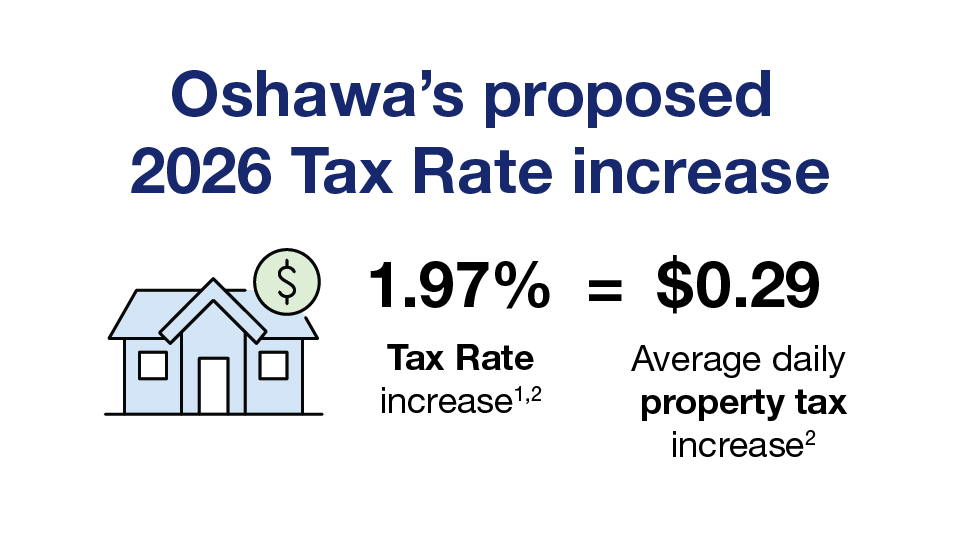

What's a Tax Rate?

The percentage applied to property assessments to collect the remaining amount needed. This rate changes based on property values and is separate from the Regional and Provincial portions.

For 2026, this equates to a Tax Rate increase of 1.97% (or approximately $0.29 daily) for the local Oshawa share of the average household’s property tax bill.

1 Based on the proposed 2026 Region of Durham Property Tax Guideline increase of 6.50%.

2 Based on the City Portion of the Tax Rate increase, which is equivalent to approximately $0.29 daily for Oshawa’s portion of an average household property tax bill.

Question & Answer

Share questions regarding the 2025 City Budget and 2026 City Budget process here. We'll do our best to get back to you within two business days.

To ask a question you must create an account or log in.

These are the people that are listening and responding to your questions.

Jay Martin

Director, Finance Services

Corporate Communications

{{question.description}}

Get a breakdown of your property tax bill

The City is inviting residents and property owners to learn more about how their taxes are used.

Property Tax Calculator

See how much City programs and services are costing you by entering your Oshawa address into the City’s Property Tax Calculator.

The Property Tax Calculator has been updated for 2025!

This handy tool gives you a personalized estimate of how your property tax dollars are split up. As a two-tier municipality, the City collects taxes not just for itself, but also for the Region of Durham and local school boards on behalf of the Province.

Did you know that for every dollar collected in 2025, the City keeps about 40 cents, while 46 cents goes to the Region and 14 cents to the Province.

Share your budget priorities

This budget engagement opportunity has now closed.

Community members could share what services and programs were important to them by adjusting funding and service levels in our Budget Simulator. Just like the City’s budget, the simulations had to be balanced in order to be submitted! Priorities could be shared online or on paper at Service Oshawa (located at City Hall, 50 Centre St. S.) and were accepted until 12 p.m. Monday, June 9.

All individual responses are anonymous and only used to summarize overall feedback received from the public. Feedback will be shared with members of Council and considered in the development of the 2026 Mayor’s Budget.